Ethereum saw an upswing, breaking through the $3,400 mark as the markets reacted to political waves leading toward a presidential inauguration.

After struggling for a week, from Jan. 11 to 17, Ethereum (ETH) broke the downward movement, pushed past its last resistance level of $3,400 and is currently trading at $3,406.72 at the time of writing.

This market optimism is driven by speculations that President-elect Donald Trump would sign an executive order related to cryptocurrency when he takes office on Jan. 20.

Discussions are also underway for this order to include a directive for all federal agencies to review their crypto policies together with the possibility of suspending ongoing litigation against industry giants.

With a leadership change anticipated, the SEC decided to settle with Abra yesterday over unregistered crypto lending products. This has set a positive motion for the entire crypto market, which saw a 3.54% uptick in the last 24 hours, as per CoinMarketCap.

Trump’s crypto-friendly stance is further strengthened with the news that pro-crypto Congressman Tom Emmer was elected Vice Chair of the Digital Assets Subcommittee on Jan. 15.

Another component which has led to ETH’s rise is the announcement of ETH’s upcoming Pectra Upgrade’s launch in the Execution Layer Meeting 203. The Pectra upgrade is eagerly awaited as a solution to some of Ethereum’s most challenging issues.

Over the years, Ethereum has faced congestion and raised gas fees. The Pectra upgrade aims to upgrade the consensus layer and enhance transaction speed and efficiency while also establishing the groundwork for seamless interoperability between the Layer 2 solutions and the mainnet, which is especially crucial for the future of blockchain expansion.

Ethereum’s price could rise further

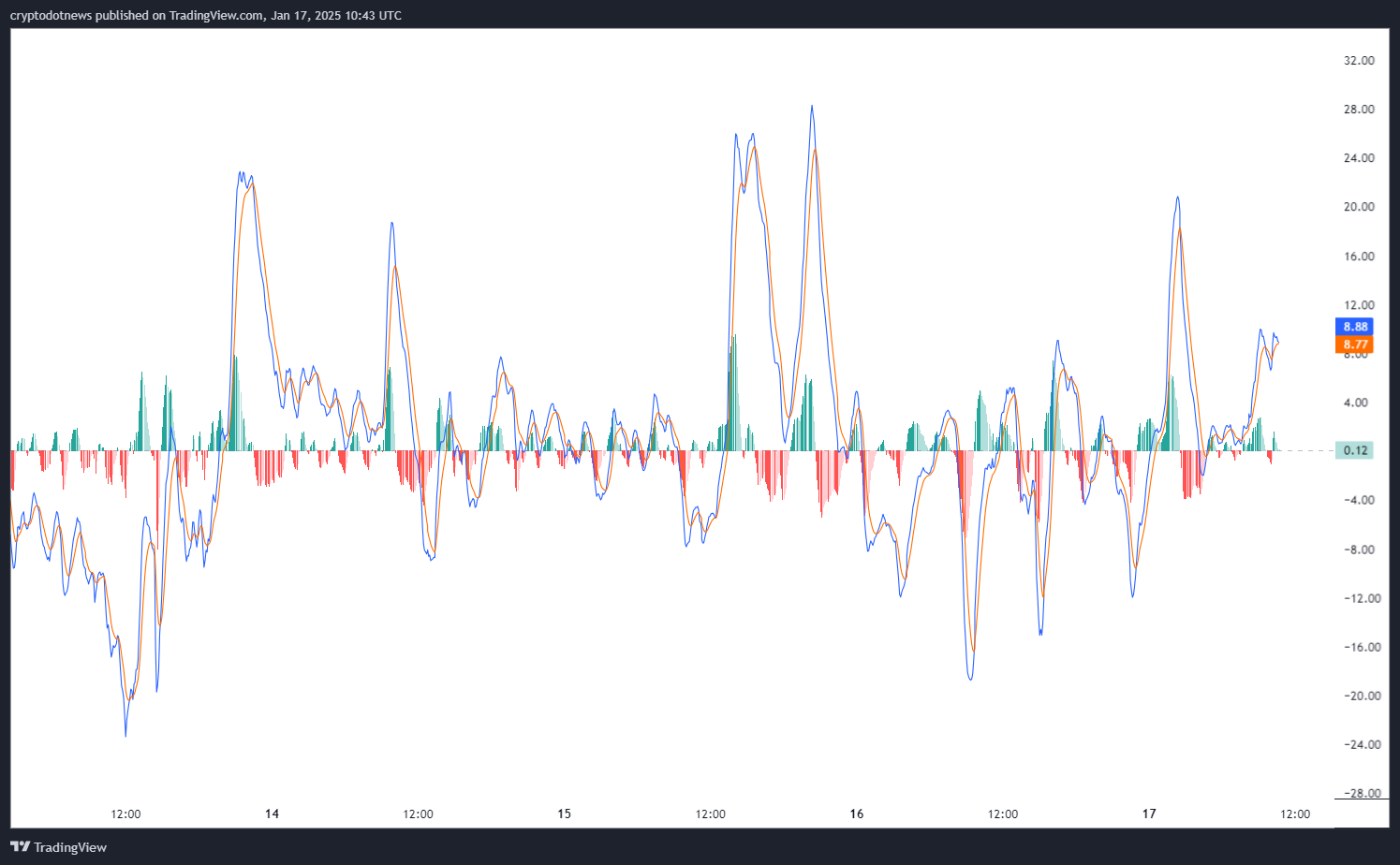

According to the Moving Average Convergence Divergence (MACD) chart, ETH is providing buy signals, meaning that, at least for the near term, some upward momentum can be expected in price increases.

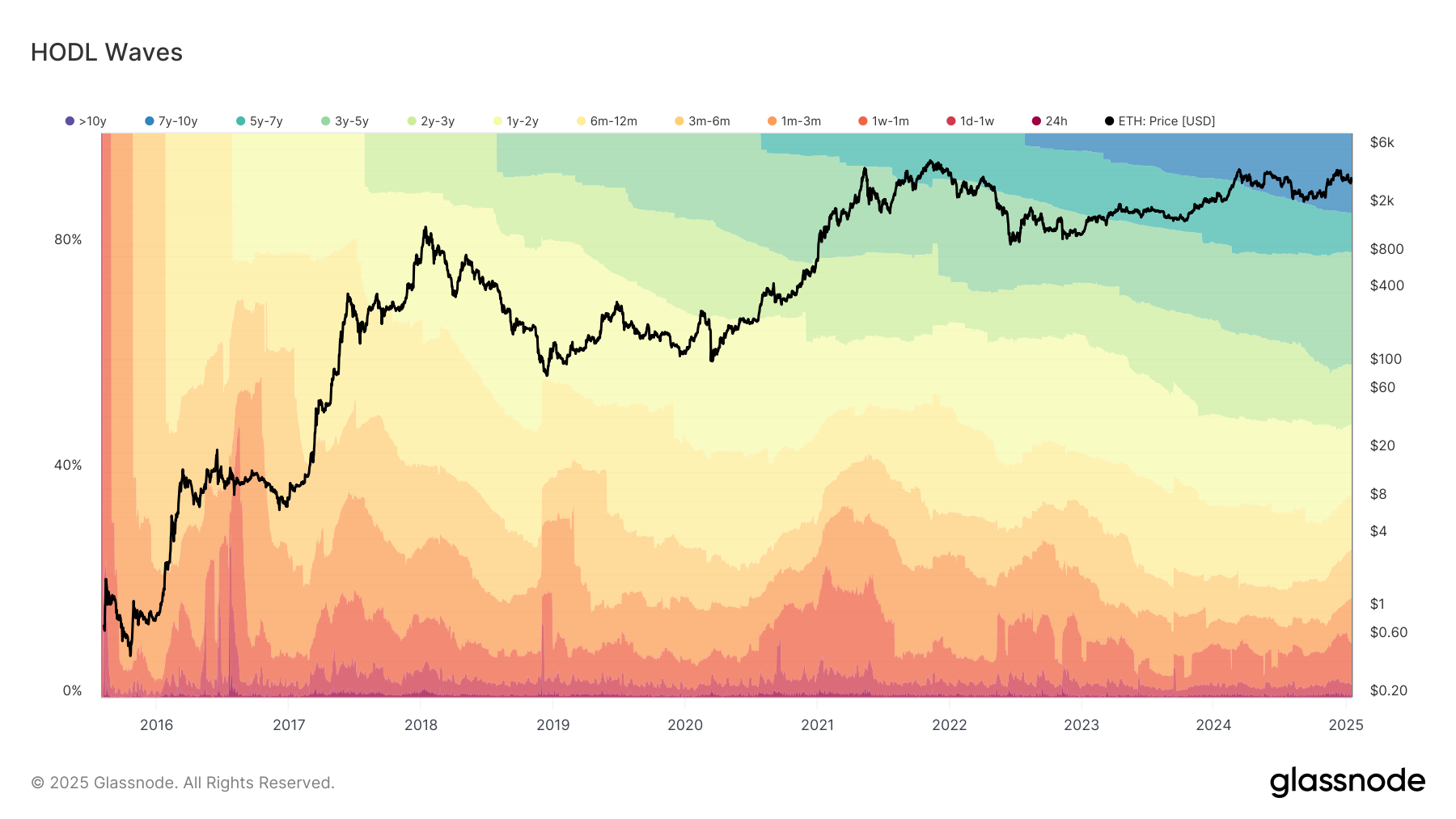

The MACD measures changes in momentum, indicating likely price trends, while HODL Waves reflect long-term holding behavior. Combined, they give an insight into future price movements.

The holding wave, HODL, expresses strong long-term holding sentiment with a substantial supply of ETH being held for more than twelve months, showing lasting investor confidence and lessened short-term selling pressure. These great events point out that ETH is a likely candidate for a potential price uptick. However, ETH prices might have minor fluctuations as the market digests these developments.