The cryptocurrency market lost $190 billion last week amid a sharp correction, bringing the global crypto market cap to $2.07 trillion by the end of the week.

Here are some of the most noteworthy performers from last week based on their significant price action and investor sentiment.

AVAX records six losing candles

Last week, Avalanche (AVAX) experienced a significant decline, losing 15.8% of its value as it closed the week at $22.81. The asset witnessed a consistent bearish trend, with six out of seven days recording losses.

Despite this downtrend, the RSI-based moving average saw a slight uptick, suggesting potential stabilization. Volume has also gradually decreased, indicating that the bearish trend could be facing a possible exhaustion.

Key areas of interest to watch in the coming days include the recent low of around $22, which could act as support if the Avalanche bearish momentum continues.

Meanwhile, a break above $24 might signal a shift in sentiment. However, AVAX’s next move could depend heavily on the strength of the broader cryptocurrency market, which triggered the recent cluster of losses.

MATIC collapses 26% in a week

Polygon (MATIC) fell sharply by 26.5%, closing last week at $0.4196.

This disappointing performance came on the back of a bearish engulfing candle on Aug. 25. Such a candlestick suggests that sellers had taken full control of the market.

Polygon recorded seven consecutive days of losses despite a surge in network activity. Amid the downtrend, it dropped below the upper Bollinger Band on Aug. 25 and the middle band on Aug. 28. However, it remains above the lower band.

This pattern suggests that the asset is in a clear downtrend but not yet oversold. In the coming days, the lower Bollinger Band around $0.3510 could serve as potential support if the bearish trend persists.

A break below this level could signal further declines.

However, a move above the middle band near $0.4568 might suggest a recovery.

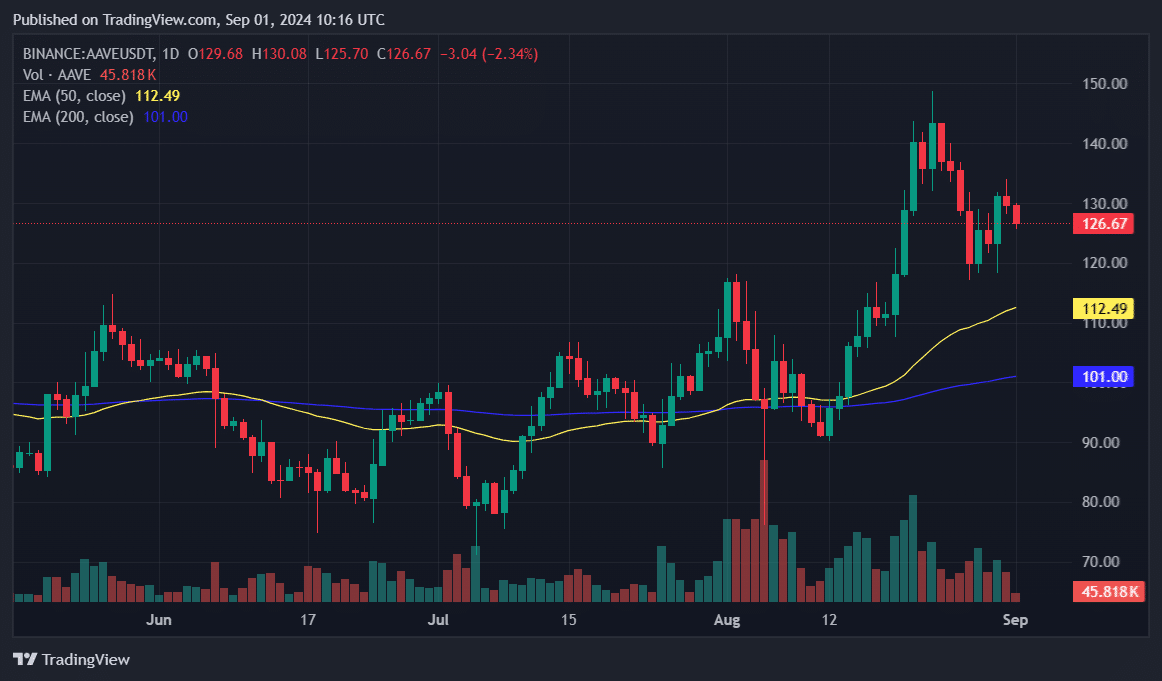

AAVE demonstrates resilience

Aave (AAVE) demonstrated relative strength last week, closing with a milder 5.37% drop at $129.71. Unlike many assets, AAVE avoided setting new lows, buoyed by two days of notable gains.

Despite the bearish pressure, the asset remained above both the 50-day EMA ($112.50) and the 200-day EMA ($101). This suggests a predominant bullish outlook in the medium to long term.

This position indicates that AAVE is currently in a stronger technical position compared to many other assets. However, the 50-day EMA around $112.50 is worthy of note in the coming days.

A dip below this level could signal a shift in sentiment. Conversely, a move above $130 could suggest renewed buying interest.